Back in 2014 I did a series of opinion pieces on the MJ Estate v. IRS Estate tax dispute. (Link here, here and here).Initially I planned to do more posts getting more technical about tax issues and valuation. However after seeing the confusion even about market value vs. tax value, I realized how complex and boring the tax discussion was for many people. So I scratched my idea of posting more opinion pieces.

From the start I believed that the true tax amount was in the middle of what MJ Estate and IRS were saying. A further look into other similar disputes confirmed this belief. So I did not see any real benefit in speculating and even arguing about what the final tax amount would be. Plus I thought the parties would come to a settlement rather quickly. Unfortunately I was wrong.

|

|

By the time the trial finally started in February 2017, I was focused on other cases. I still felt the same way about IRS case – that I did not want to do technical complex (and even boring) posts and that the true amount was somewhere in the middle. I was optimistic that a major media source would report on the case regularly but that did not happen. While media occasionally reported intriguing testimony, they too did not seem to be interested in reporting the complex valuation issues.

However one thing from the opening statements stood out to me. It seemed like neither the media nor the majority of the fans were realizing that the tax deficiency had already been significantly reduced.

Before I explain what I mean, a brief but important background on the MJ Estate v. IRS situation. After Michael’s death MJ Estate filed their Estate tax return. IRS disagreed with MJ Estate valuations and issued them a notice of deficiency for $505.1 million in taxes and $196.9 million in penalties ($702 million in total). (Executors valued the Estate at $7 million while IRS valued it over a billion dollars). Estate filed a petition at the tax court challenging IRS. This is very important – IRS is not suing MJ Estate or Executors. To the contrary MJ Estate challenged IRS. Trial was put on hold for parties to engage in settlement discussions.

During this settlement talks, parties settled everything but valuation of the 3 most valuable assets:

- - MIJAC – initially valued at $60,685,944 by IRS and $2,207,351 by MJ Estate

- - Sony/ATV – initially valued at $469,005,086 by IRS and 0 by MJ Estate

- - Image and likeliness – initially valued at $434,264,000 by IRS ad $2,105 by MJ Estate

So although the majority of the issues were settled in a favorable way for MJ Estate and meant less taxes, it was a very minor thing. The remaining 3 disputed assets were valued over $960 million by IRS which could resulted in around $600 million in taxes and penalties. Not that much different from the original $702 million deficiency.

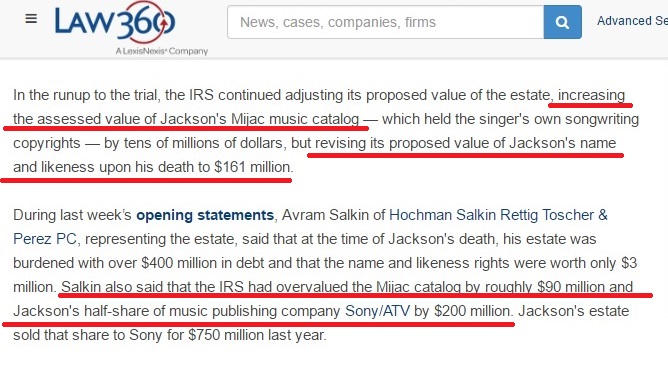

However over the years of settlement talks both parties had adjusted their valuations so that numbers no longer hold true. Media reported some of the adjustments over the years. For example in July 2014, IRS increased the tax deficiency and penalties by $29 million because they increased their initial valuation of Jackson 5 master recordings (This was later settled). In June 2016, they increased their valuation of MIJAC by $53.6 million bringing it to $112 million. (link)

Then came the news of the opening statements. IRS continued to adjust their valuation of the Estate assets. So did the MJ Estate – for example increasing image and likeliness valuation to $3 million. IRS had increased the value of MIJAC – which media was reported before as it can be seen above. However IRS had reduced their valuation for both Sony/ATV and image and likeliness. I saw one fan comment on this at twitter. If they reduced the valuation, how could the taxes and penalties could still be $700 million? the fan asked. Simple answer, it can’t be. Any reduction in valuation should mean reduction in taxes and possible penalties.

Let’s think about it for a minute. Keep in mind that these are the rough round numbers mentioned by Estate’s lawyers and there is some inconsistency among the sources (MIJAC $112 Million reported in June 2016 versus $90 million mentioned during opening statements). Regardless they are still enough to provide us a rough picture. Here is a closer look to adjustments by IRS

- - Image and likeliness now $161 million down from $434 million - $273 million decrease

- - Sony/ ATV now around $200 million down from $469 million - $269 million decrease

- - MIJAC now around $90 million up from $60 million - $30 million increase

Overall the valuation of the remaining 3 major assets were decreased roughly around $500 million. That would roughly mean a reduction in taxes and penalties around $300 million alone. Add to that the tax & penalty reduction from the settled issues and you will realize that before the parties even set foot to the courtroom for the trial, the tax deficiency was significantly reduced. Establishing once again that the true tax value is somewhere in the middle.

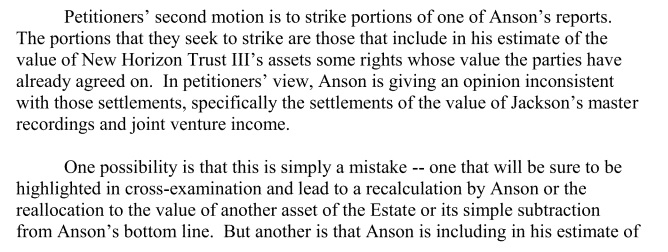

Of course this doesn’t rule out further adjustments – either increase or decrease. For example just days before the trial MJ Estate complained about IRS’s expert is using different values than the parties agreed during settlement for his calculation for MIJAC. In his ruling Judge said this could simply be a mistake, IRS expert could do a recalculation or even they can simply deduct the difference from his valuation. Perhaps this adjustment explains the difference of June 2016 reported valuation of MIJAC at $112 million and $90 million mentioned during opening statements. Regardless it shows further adjustments/corrections are possible. And not just decreasing them, I wouldn’t rule out IRS increasing any valuation as well. The dynamic nature of the valuation and how both parties kept adjusting their valuations till the last minute demonstrates anything is possible.

Now with the trial over, the ball is in judge’s court. (Due to the complex nature of tax and valuation matters this is a bench trial meaning there is no jury, just a judge). Judge will decide the valuation and hence the tax amount as well as penalties (if any). It might take some time (weeks to months) for the Judge to decide. Judge orders/opinions are posted on the Tax Court website accessible by anyone at no cost. Keep in mind that it is possible for either party to file an appeal of judge’s decision.

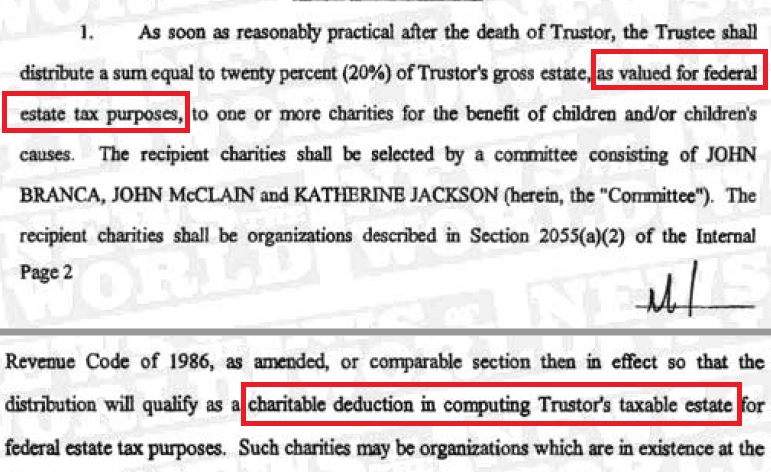

Once the Estate valuation is settled, 20% of the Estate will be given to charity per Michael’s trust. The reason that the charity donation didn’t happen before is that it required determination of the estate value for tax purposes and that has been in dispute between the MJ Estate and IRS. The charity donation will be used as a deduction lowering the Estate tax as well.

(Clarification note/edit : l was alerted that Estate's lawyer have said that Estate "gives" 20% to charity - sounding like charity donations are already happening. Source tweet from Teammichael777 can be seen below)

In disputes like this, people like to determine a winner and a loser, a party who is right, a party who is wrong. It would depend on your individual perceptions. For example you can look the settled issues and Estate conceding to higher amounts than their initial valuations and you can see that as proof that Estate was wrong. Another person can look to IRS’s reductions in valuations and see that as a proof that IRS was wrong.

The reality is that this will be a “win-lose” situation for both parties. In other words Estate will “lose” because most probably they will need to pay taxes more than they initially reported but will “win” because most probably they won’t pay as much as IRS initially asked. Same will be true for IRS. IRS will “win” because they will probably collect more than Estate initially reported but will “lose” because they will probably not be able to collect what they asked initially. However most probably both parties will portray the outcome as a huge win for them.

Now we wait for the judge’s ruling.

PS: I was intentionally vague in calculations as I did not want to be overly speculative or give definitive numbers. It's a dynamic situation and valuations can change.