{socialbuttons}

The dispute between MJ Estate and IRS isn't new and there haven’t been any new developments but after seeing some confusion about valuations and seeing how it still comes up during conversations, I decided to do a two part opinion series about this topic.

In this first part I would cover the basics about Estate tax, valuation, market and tax value of the catalogs. In the second part I will mention valuation of image and likeliness and the possible outcomes. So let’s get started!

What is Estate tax? The estate tax is a tax on property (cash, real estate, stock, or other assets) transferred from deceased persons to their heirs. It's paid only once. It requires an accounting of the property of the deceased at the date of the death. The values of the property – also known as gross Estate- are determined and then deductions –such as liabilities and debt - are taken out to determine the net value. Tax is determined based on this net value.

Two very important points to remember from the above definition is that:

1.Value of the Estate is determined at the date of death

2.Tax value (net value) = Market value (gross value) – deductions

A little more information about valuation at the date of death: "The tax value of the property is the amount a hypothetical ‘‘willing buyer’’ would pay at this moment to a ‘‘willing seller’’ for the asset, with ‘‘neither being under any compulsion to buy or to sell and both having reasonable knowledge of relevant facts.’’ Thus,any valuation must take into account only information that would have been available to the hypothetical buyer and seller at the moment of death, and must not reflect postmortem changes in value".

As you can see the logic of the valuation is if Michael (didn’t die and) was selling his assets on June 25th, 2009 how much money would he get. Any postmortem changes – such as MJ’s increased popularity after death and the money Estate earned – are irrelevant to determination of Estate tax. It’s based on the value on June 25th, 2009 and what people reasonably knew on that date.

Just this could be enough to explain the low estate tax reported by MJ Estate. If Michael was in hundreds of millions of debt, close to defaulting on multiple mortgages and on loans on catalogs and therefore needed to generate money by agreeing to go on tour however whether or not that tour would happen wasn’t certain (media reports of illness, delaying of tour dates and so on), it would explain the low tax reporting based on the situation and what was known on June 25th, 2009.

As for the “Tax value (net value) = Market value (gross value) – deductions” we’ll need to use the available limited information. (We only have one court document that doesn't provide any details about valuations and several media /tabloid reports on this subject. Therefore unfortunately I’ll be using media/tabloid reports but I will try to validate and double check the information from other sources as well. )

For Sony/ATV catalog the court document only states that Estate’s shown on return value is $0, where as IRS’s shown on return value is $469 Million. It’s important to remember that these shown on return values are the tax value /net value which is calculated by deducting liabilities from the market value. In other words Estate didn't value Michael’s share as $0, they reported it was $0 after the deductions.

Do not believe me? Well luckily the court response by IRS provides proof of this calculation for MIJAC catalog.

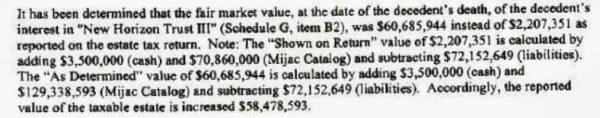

Let’s read it shall we? MJ Estate’s “shown on return” (aka tax value / net value) for MIJAC catalog is $2 Million where as IRS’s “shown in return” value is $60 Million. IRS explains the calculations:

MJ Estate calculation for shown on return (tax value) = $70,860,000 (market value) + $3,500,000 (cash/income) - $72,159,649 (liabilities/loans) = $ 2,207,351

So as you can see according to the Estate the real market value of the MIJAC catalog is $74.3 Million, where as the tax value /shown on return value is $2 Million after the liabilities/ debts/loans is subtracted from the market value.

The same applies to Sony/ATV catalog as well. Estate did not say the market value of the catalog is $0, they said the tax value is $0 after you deduct all the liabilities/debts/loans on the catalog.

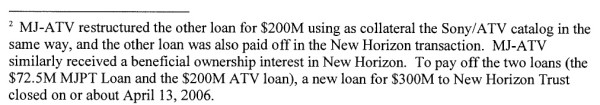

So the question becomes what are the debts/liabilities/loans on the catalog. From the 2006 Prescient lawsuit we know that MIJAC had $72.5 Million loan (confirms the above liabilities number) and Sony/ATV had $200 Million loan on it. Michael was getting a $300 Million loan to cover those loans plus $27.5 Million. We don’t know if there have been other loans taken against Sony/ATV between 2006 and 2009 but media reported the loans on Sony/ATV was $320 Million.Estate’s own probate accounting documents would state the Sony/ATV loan was around $300 Million at the time of MJ’s death.

So if we assume that the loans on the Sony/ATV catalog was $300 Million, a little reverse math would show us that to get to $0 shown on return value, the gross value / market value of Michael’s share should be at least $300 million.

TMZ posted a valuation from Beatles expert / tax attorney Bruce Spizer who said “the catalog definitely worth at least $300 Million and could be as much as $400 Million”. TMZ and some fans failed to realize that this valuation actually would confirm Estate’s valuations. If the catalog is definitely worth at least $300 Million (market value/gross value) and if you deduct $300 Million in liabilities the shown on return / net value/ tax value would be $0. Similarly Eric Briggs testified (during Jackson v. AEG trial) that he valued MJ’s share “roughly in line with debt” which again explains the $0 shown on return.

A few days later TMZ posts another article saying that the whole Sony/ATV catalog was actually valued at $1.5 Billion by the Estate. TMZ continues to explain “there was a $700 million loan taken against the purchase of the catalog, bringing the net value to $800 million. Michael and Sony were 50/50 partners ... which mean Michael's share was around $400 million. Now the debt. Michael leveraged his interest to the hilt -- he borrowed $320 million against the catalog. And He owed another $200 million in personal debt ... And that's why they put ZERO.” As you can see TMZ’s explanation is also in line with Briggs’s testimony that the market value of the catalog was in roughly in line with the debt on it – hence the $0 tax value.

By now it should be clear that the $0 is the tax value and not the market value of the Sony/ATV catalog.

The next logical question to ask why is there a difference between Estate and IRS calculations? If you look to MIJAC information, you’ll see that Estate and IRS agrees with the loan/debt amount as well as the cash/income but they disagree in regards to the market value of the catalog. While Estate market values MIJAC catalog at $70 Million, IRS market values it around $129 Million – 1.8 times more than MJ Estate. TMZ states Estate valued Sony/ATV at $1.5 Billion but IRS values it at double the amount – which fits with IRS valuing MIJAC 1.8 times more.

(Side note: I did a little calculation making some assumptions using the information from the court document as well as TMZ.

IRS value of Sony/ATV = 1.8 x $1.5 Billion (Estate valuation) = $2.7 Billion.

$2.7 Billion - $700 M (loan taken against purchase) = $2 billion.

MJ's share gross value= $1 billion. MJ's debt = $520 Million. MJ's net share = $480 Million.

IRS reported on return value(on court document) = $469 Million.

So if we use TMZ's numbers and assume IRS values everything 1.8 times higher, we can get a close match to the IRS reported number)

Therefore we can see the main issue in regards to this dispute is IRS determines the market value of the assets almost double than the Estate does and therefore it results in huge differences.

“Who is right in valuation of the assets?” is the next question that comes to mind. The answer is we don’t know and we will have to wait and see to find the answer. It would be a matter of who has the best expert and who used the most appropriate method of valuing the catalogs.

If you read a previous opinion piece I posted (Is IRS always right) you will see that sometimes IRS uses their own appraisers who do not necessarily have the expertise about some very specific assets whether they are American Western Art or a music catalog. On the other hand MJ’s catalogs were valued multiple times in the past for loan purposes. Eric Briggs had testified that he valued them 5 to 10 times for different clients – not only MJ Estate but also Fortress Capital, Goldman Sacks, Sony/ATV and a law firm in 2007. So the appraiser used by MJ Estate definitely looks like they have the experience and their valuations were used in the past as well. If this goes to trial, IRS appraiser’s background would become an important factor to determine who is correct in their catalog valuations. Furthermore IRS commonly uses higher valuation as negotiation tactic (more about this on part 2)

A little note: Back in the day while tweeting about this subject, I made a comment about this being “basic math”. I wasn't calling valuation of assets as “basic math”. However I believed understanding the tax value (shown on return value) equals market value minus debt was a simple math concept (subtraction) that everyone could or should understand.Apparently some are still having a hard time with understanding this.

Coming up on the next part: Valuation of image and likeliness and the possible outcomes and what it might mean for the Executors.